2024 marks the 20th anniversary of the formal introduction of the ESG concept. Although the globalization process faces many challenges, China's ESG field has ushered in a new stage of vigorous development. The following is a review and analysis of major ESG policies in China this year.

1、 Comprehensive reform of ESG regulatory framework

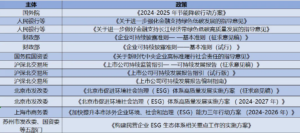

In 2024, China's ESG sector will undergo a comprehensive reform of information disclosure rules. At the beginning of the year, the Shanghai, Shenzhen, and Beijing stock exchanges, under the guidance of regulatory authorities, were the first to release draft ESG reporting guidelines and widely solicited market opinions. After two months of in-depth communication and revision, the guideline was officially released in April and will be implemented from the following month onwards.

According to the new guidelines, constituent stocks of the SSE 180, STAR Market 50, Shenzhen Stock Exchange 100, and ChiNext Index, as well as companies listed both domestically and internationally, are required to disclose their ESG performance for the year 2025 in accordance with the new regulations in 2026. The regulatory authorities not only require the above-mentioned companies to comply, but also encourage other listed companies to actively participate and strictly follow the guidelines for information disclosure, strictly prohibiting selective disclosure behavior.

To assist listed companies in better preparing ESG reports, regulatory authorities have guided exchanges and listed company associations to jointly conduct special training and develop detailed work guidelines. In September, the China Association of Listed Companies launched the "Guidelines for the Preparation of Sustainable Development Reports for Listed Companies", which provides more practical guidance for listed companies to accurately grasp and implement the new ESG reporting guidelines.

In addition, the Ministry of Finance released the "Basic Guidelines for Corporate Sustainable Information Disclosure (Draft for Comments)" in May, marking a solid step for China in the field of ESG information disclosure. This standard will apply to all Chinese companies and become the national standard for ESG practices and information disclosure. In the next three years, the Ministry of Finance plans to gradually introduce more specific ESG disclosure rules and is committed to building a comprehensive national unified ESG disclosure rule system by 2030.

2、 The Construction of ESG Ecosystem in Hong Kong Region

In March, Hong Kong issued a declaration to build a sustainable information disclosure ecosystem and commissioned the Hong Kong Institute of Certified Public Accountants (HKICPA) to develop ESG rules that are in line with Hong Kong's characteristics. In April, the Hong Kong Stock Exchange announced that it would comply with the International Sustainability Standards Board's (ISSB) climate disclosure rules (IFRS S2), requiring Hong Kong listed companies to disclose information related to climate change. These new rules, together with the existing ESG reporting guidelines, constitute Hong Kong's ESG code of conduct.

In September, HKICPA released two draft rules that fully adopted ISSB standards. They are expected to be officially released within the year and will come into effect on August 1, 2025. According to statistics, in 2024, more than half of the listed companies in the A-share market and all Hong Kong listed companies voluntarily released ESG reports, demonstrating the market's positive response to ESG concepts.

3、 Climate Transition: Policy Leadership and Financial Support

Climate change, as the core of environmental issues, has always been a concern. Since China proposed the "dual carbon" target, climate change has occupied an important position in national policies. The National Ecological Environment Protection Conference emphasized that the next five years are a critical period for the construction of a beautiful China, and high-quality ecological environment should support high-quality development and promote the modernization process of harmonious coexistence between humans and nature.

Under the guidance of top-level design, various ministries and commissions of the State Council have introduced a number of specific policies in finance, taxation, banking, and industry. Among them, the Opinions on Giving Play to the Role of Green Finance to Serve the Construction of a Beautiful China jointly issued by the People's Bank of China and other four departments clearly put forward the requirements of building a unified standard system of green finance and transformation finance, promoting financial institutions and business entities to explore ESG evaluation, and encouraging enterprises to formulate transformation plans.

As of July 2024, China has guided banks to issue over 1.1 trillion yuan in loans through financial instruments, supporting emission reduction projects and benefiting more than 6000 enterprises. The validity period of this financial instrument has been extended to 2027, providing strong financial support for China's climate transition.

In addition, China's carbon market has made significant progress in 2024. The national greenhouse gas voluntary emission reduction trading market has restarted, and the first batch of China's Certified Voluntary Emission Reduction (CCER) projects have begun online trading. At the same time, the national carbon emission trading market has expanded its coverage to include industries such as cement, steel, and electrolytic aluminum, and has designated 2024 as the first control year, with plans to complete the first compliance work by the end of 2025.

4、 Trade Compliance: New Challenges and Opportunities for ESG

In recent years, the global emphasis on ESG has been continuously increasing, and relevant regulations have been continuously upgraded. The EU is particularly prominent in this regard, introducing a series of new regulations aimed at addressing climate change and improving supply chain management. In 2024, the European Union passed two important regulations to further strengthen ESG requirements.

The regulation "Empowering Consumers to Achieve Green Transformation" came into effect in March, aiming to prevent businesses from exaggerating marketing and misleading consumers. The 'Due Diligence Directive on Corporate Sustainability' came into effect in July, requiring companies to avoid negative impacts on the environment and labor in all activities, and ensure that their business models and strategies are in line with the goals of the Paris Agreement. These regulations not only require companies to be environmentally and socially responsible themselves, but also require them to ensure that suppliers in the supply chain comply with ESG standards.

Faced with these challenges, Chinese export enterprises, especially new energy vehicle, lithium battery, and solar panel manufacturers, as well as cross-border e-commerce companies, need to establish a sound ESG management system, improve ESG information disclosure transparency, enhance ESG ratings, and enhance their competitiveness in the international market.

For enterprises with production, operation, and financing needs abroad, ESG performance is equally crucial. The China International Contractors Association released the "ESG Management Guidelines for Foreign Contracting Engineering Enterprises" standard in 2024; Meanwhile, the three major stock markets in China also require companies listed both domestically and internationally to publicly disclose their ESG reports. A research report from Caixin Think Tank points out that ESG has become a "new threshold" and "new opportunity" for overseas enterprises.

In summary, ESG is gradually penetrating from the international level to the domestic level, from macro planning implementation to concrete practice, reshaping global economic rules. Although there are differences in the acceptance of ESG globally, for China, ESG is a clear development goal with enormous market potential. We should seize this historical opportunity, rise rapidly like China's new energy industry, surpass competitors, and continuously strive towards long-term goals.