How to view the current global trend of sustainable development? This is a complex issue involving the global landscape. The survey results show that over half of the students believe that the world is moving towards sustainable development, and this optimistic attitude is gratifying. However, the answer to this question may vary from person to person, mainly depending on the following three perspectives:

Vision and cognition: Many people, driven by their longing for a better future, believe that the world should move towards sustainable development.

Actions and Efforts: We have taken many positive actions, such as protecting the environment and developing clean energy, which have laid the foundation for achieving sustainable development goals.

Reality: However, we must objectively assess the actual global situation. Climate change, resource depletion and other issues remain severe, which requires us to be more cautious in judging whether the world has truly embarked on the path of sustainable development.

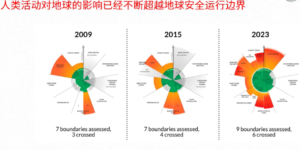

So, how should we make this judgment scientifically? The impact of human activities on the Earth has continuously surpassed the safe operating boundaries of the planet.

In 2009, top scientists around the world jointly proposed the concept of "Earth's safe operating boundary", comparing the Earth system to a "spacecraft" carrying human civilization. This' spacecraft 'has nine critical' system control panels', and once the value of one of the 'panels' exceeds the safe range, the entire system may lose control. These 'panels' include climate change, biodiversity, land use, freshwater resources, and more.

Unfortunately, in the past fourteen years, the values of multiple "panels" such as climate change, biodiversity loss, and nitrogen cycle imbalance have turned red, and the Earth's ecosystem is facing severe challenges. At present, only three "system control panels" are still within the safe range.

Scientific research has clearly shown that the Earth's ecosystem is in danger, and this deterioration trend is accelerating. Despite the increasing global consensus on sustainable development, the strength and effectiveness of actual actions are far from sufficient to address the current crisis. What has led to this worrying situation?

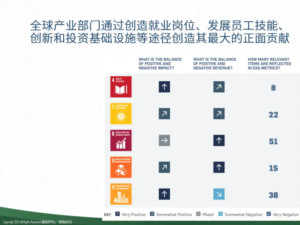

The United Nations conducted a comprehensive survey of all enterprises worldwide, including state-owned and non-state-owned ones. Research has found that business plays a positive role in economic development, promoting economic growth, creating employment opportunities, and driving the process of urbanization. However, in the field of the environment, commercial activities have put enormous pressure on water resources, climate systems, and biodiversity, showing significant negative impacts.

Specifically, the comprehensive survey of global industrial sectors conducted by the United Nations organization shows that:

Economic field:Business has played a positive role in economic growth, employment, urbanization, and other aspects.

Environmental field:Commercial activities have had negative impacts on water resources, biodiversity, climate change, and other aspects.

Social field:The role of business in social development is complex, with both positive contributions and negative impacts such as inequality and social injustice.

By combining the two images, we can draw the following conclusion:

Global sustainable development is facing challenges: Despite the important role played by enterprises in economic development, their negative impact on the environment and society cannot be ignored, which is one of the important reasons for global unsustainable development.

Business models urgently need to transform: Enterprises need to shift from simply pursuing profit maximization to sustainable business models, creating long-term value, and taking on more social responsibilities for all stakeholders.

The concept of ESG (Environmental, Social, and Corporate Governance) has become a hot topic in the global business community. Regardless of the industry, companies should actively address ESG challenges and integrate sustainable development concepts into their operations.

Traditional beliefs hold that the primary goal of a business is to maximize profits by transferring environmental and social costs to society. However, with the increasingly serious environmental problems, this viewpoint is no longer applicable. Enterprises must recognize that pollutants are generated by their own production and business activities, and should bear the responsibility of governance. Transferring environmental costs to society, especially vulnerable groups, is unethical and unsustainable.

In the past, many industries overlooked the importance of ESG in pursuit of short-term benefits. This development model is not only unsustainable, but also has long-term negative impacts on society. If companies continue to externalize environmental and social costs, we will not be able to achieve sustainable development goals.

The labor dispatch industry is a typical example. Labor dispatch companies often harm the rights and interests of dispatched workers in pursuit of profit maximization, which is neither ethical nor sustainable. To achieve sustainable social development, it is necessary to change this business model that harms social welfare.

The essence of ESG is to drive companies to take on corresponding social responsibilities while pursuing economic benefits, transforming from creators of environmental and social issues to solvers, thereby achieving sustainable development. Only by integrating ESG concepts throughout business operations can we build a more equitable and sustainable society.

Worldwide, people have been committed to promoting businesses to play a more active role in society. As early as the beginning of the last century, charitable donations have become a way for businesses to give back to society. The concept of "corporate social responsibility" proposed 70 years ago aims to encourage companies to consciously take on social responsibility and become responsible "corporate citizens". However, due to the many privileges enjoyed by enterprises, such as limited liability systems and the exploitation and use of natural resources, accompanied by the enormous power they possess, there are many shortcomings in fulfilling their social responsibilities. Although the concept of corporate social responsibility is widely spread, its actual effect is not ideal and it has not effectively constrained corporate behavior.

The ESG concept proposed 20 years ago provides a more comprehensive and systematic framework for corporate social responsibility. ESG focuses on the three dimensions of environment, society, and governance, aiming to promote the integration of sustainable development concepts into daily operations of enterprises. With the popularization of ESG concepts, it has become an important indicator for measuring the sustainable development performance of enterprises.

Many people believe that ESG was invented by Western countries as a tool to constrain Chinese industry from catching up with them. The proportion of people holding this view gradually decreased from the initial 25%. Two years ago, this view was still very common. Whenever ESG was mentioned, it was seen as a shackle that bound oneself and a conspiracy. However, it is gratifying that in this survey, the majority of students chose 'ESG is a tool for managing and evaluating a company's environmental and social impact', which is more in line with the facts. For those who hold conspiracy theories, my usual answer is: firstly, ESG was not invented by any Western scholar. If we have to find an 'inventor', the late former Secretary General of the United Nations, Kofi Annan, has been committed to promoting global sustainable development and deeply recognized the role that businesses play in global sustainable development. He proposed at a conference in 2002 that sustainable development worldwide can only be a distant dream without the active participation of businesses.

Annan has a very clear understanding of this, so he has done a lot of promotion work. In 1999, as soon as he became the Secretary General of the United Nations, he delivered an important speech at the World Economic Forum, hoping that the controllers of large commercial capital present could inject humanistic elements into globalization, otherwise globalization would inevitably come to an end. In 2004, he personally invited decision-makers from globally renowned financial companies and research institutions to engage in discussions, ultimately leading to the birth of the ESG concept. In 2006, he co launched the Responsible Investment Principles (PRI) with heads of large financial institutions at the New York Stock Exchange, marking the first step in global ESG practices. The 'Responsible Investment Principles' require financial institutions to incorporate ESG principles into their operational processes, marking the beginning of ESG practices.

Therefore, ESG is not a concept first proposed by a Western scholar, but rather an initiative and attempt by the United Nations in the global context. We have been working hard to promote corporate social responsibility, but at least so far, the company's performance still falls far short of our expectations.

The global development situation of ESG is complex, and China's ESG policies are rapidly developing

ESG stands for Environmental, Social, and Governance, and is also considered a model for measuring a company's non-financial performance. In 2024, ESG has become the latest "sensitive term" in the United States, a term that many people are unwilling to mention. ESG has become a focal point of partisan interest in the United States, as the Republican Party represents the interests of fossil fuels, while the Democratic Party represents new environmental policies such as climate change. In this sense, ESG is not desirable for Republicans because it represents bidding farewell to and ending the fossil energy era, which also implies significant political challenges. Before the US presidential election, businesses generally remained silent, especially in the uncertain situation of the election.

Looking at Europe again. Europe is the biggest driver of ESG, and the main driving force of global ESG comes from Europe rather than the United States. Many people believe that after the Russia Ukraine war, the European Union may back down on ESG policies due to the risk of energy crisis caused by cutting off imports of electricity and natural gas from Russia, but in reality, it has not. On the contrary, the Russia Ukraine conflict has accelerated the EU's transition towards renewable energy.

This June is the EU's five-year parliamentary election, in which the EU Parliament plays an important role in EU decision-making. There are several major changes in this election. Firstly, although the far right does not hold a dominant position, its influence has significantly increased, with its seats rising to over 10%. Secondly, the Green Party suffered a setback in this election. One of the reasons why the European Union has been most aggressive in global ESG policies in the past five years is due to the significant increase in seats for the Green Party in the last election, which has enabled the Green Party to play an important role in European politics. Now that the election has suffered setbacks, the EU's efforts to promote ESG policies in the next five years are worrying, and environmentalists are also concerned about this.

The European Union has introduced several newly introduced laws, and business owners may be aware of the Carbon Border Adjustment Mechanism (CBAM) launched by the EU. This is just the beginning, and a series of regulations such as the Corporate Sustainability Reporting Directive and the Corporate Sustainability Due Diligence Directive are about to be implemented. After the EU regulations are passed, they need to be translated into domestic laws in member states such as Germany, the Netherlands, and Spain before they can be implemented. This nationalization process takes about two years. After these laws are officially implemented, their impact on Chinese companies will far exceed the scope of carbon tariffs. After the re-election of the European Parliament, people are worried that the parliament may even overturn some of the more radical environmental laws passed in the previous session, and environmentalists are very concerned about this.

Compared with the United States and the European Union, China's ESG policy presents a unique path. 2024 is widely regarded as a turning point for ESG information disclosure in China. Although in recent years, departments such as the State owned Assets Supervision and Administration Commission and the People's Bank of China have been promoting ESG development, it was not until January 11, 2024, when the Central Committee of the Communist Party of China and the State Council issued the "Opinions on Comprehensively Promoting the Construction of a Beautiful China", that ESG was elevated to the highest strategic level of the country. This document clearly proposes to deepen the reform of the legal disclosure system for environmental information and explore the evaluation of environmental, social, and corporate governance, marking the Chinese government's high attention to ESG. Although the document does not directly use the abbreviation "ESG", it first mentions the concept of "environmental, social, and corporate governance". This is a barometer - in China, it is extremely important to incorporate this concept into the highest policy level of the country.

On February 8th, the three major stock exchanges responded quickly and released a draft for soliciting opinions on the "Guidelines for Sustainable Development Reports of Listed Companies", which was officially adopted on April 12th. In addition, seven ministries jointly launched the "Guiding Opinions on Further Strengthening Financial Support for Green and Low Carbon Development", requiring the inclusion of ESG assessment results in the corporate credit evaluation system. Previously, ESG did not have a direct impact on a company's credit rating, so the proposal of this opinion is of great significance. The Ministry of Finance has also proposed the "Corporate Sustainability Disclosure Standards", which not only require listed companies to disclose, but also require all companies to disclose.

This year, China has introduced a series of relevant policies, which are in sharp contrast to the practices of Europe and America. So far, many companies believe that ESG is not related to themselves, but from various signals, there will be more and more policies in the future that closely link ESG with their production and operation.

Identify misconceptions about ESG and maintain a clear mind amidst the current ESG craze

Despite the current high popularity of ESG and frequent forums, I believe we need to remain calm and think deeply. There are currently some misconceptions about ESG that need to be identified and corrected.

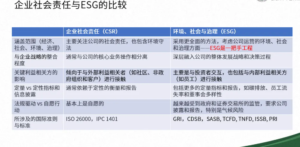

Misconception 1: Equating Environmental, Social, and Corporate Governance (ESG) with Corporate Social Responsibility

Many people equate ESG with corporate social responsibility, which is a big misconception. Give two examples of corporate reports: Xinhua Insurance's "Environmental, Social Governance, and Corporate Social Responsibility Report" and China Eastern Airlines' "Corporate Social Responsibility and ESG Report". Nowadays, many companies establish social responsibility departments to be responsible for ESG work, but this approach is actually a misunderstanding and one sidedness of ESG.

The above figure shows the difference between corporate social responsibility and ESG. The key points are as follows:

Firstly, the decisive role of governance. ESG is a top-level project that requires corporate governance to take the lead, and must be promoted from the board of directors to the general manager, from top to bottom. If you are a senior decision maker in the company, there is still a lot of room for promoting ESG work; But if you work as a middle-level employee in a large company, promoting ESG on your own will face great difficulties. In the concept of ESG, I advocate putting G at the forefront and changing it to GES, because corporate governance determines the performance of a company's environmental and social factors. In ESG ratings, G typically accounts for over 40%, which is higher than one-third. Chinese companies often perform poorly in the G aspect of ESG ratings, with lower scores.

Secondly, the quantitative characteristics of ESG. Without quantification, there can be no ESG, everything speaks for itself with data. Most corporate social responsibility reports tell stories, and I sometimes joke that printing corporate social responsibility reports will waste paper and damage forests? Because these CSR reports, which are primarily based on qualitative narratives, cannot provide key readers with assistance in their investment decisions. ESG emphasizes quantification, and in the future, monetization will be achieved on the basis of quantification.

Thirdly, the main focus of ESG is on investors. The most concerned and influential audience for ESG is investors, who directly affect a company's ESG performance. Corporate social responsibility reports are more geared towards the government and society. These differences are essential and cannot be simply seen as upgrades from 1.0 to 2.0. Although the purpose of CSR and ESG is to drive companies towards sustainable development, the means are different. Promoting social responsibility in enterprises is like parents telling their children, 'You should study hard, which is good for your future development, as well as for your family and society.' This is mainly an external call. ESG, on the other hand, establishes a standardized examination system and rewards and punishments based on the examination results. Imagine what changes would occur in China's secondary education if the college entrance examination were cancelled. This is the reality, it is difficult to achieve solely by calling on enterprises to "do good things".

Misconception 2: ESG is synonymous with information disclosure

Many people equate ESG with publishing information disclosure reports, believing that as long as the report is well printed and the story is vividly told, the task is considered completed. This perception is a one-sided understanding of ESG. In fact, ESG information disclosure is only the first step in the entire process, and the key to reporting lies in comprehensively evaluating and assessing a company's performance in environmental, social, and corporate governance aspects. More importantly, this information should have a substantial and long-term impact on investors and other stakeholders.

To truly play a role in ESG, a closed-loop system must be formed from information disclosure to ESG rating, and then to investor decision-making, so that companies can reflect their long-term value in the market. The above figure shows that the role of ESG not only lies in risk and compliance, but also involves operational efficiency, value dividends, and strategic development - these are the key paths for enterprises to continuously enhance value through effective ESG management. At present, China has just started in the field of ESG rating, and compared with the mature international ESG rating system that combines credit ratings, it is still in the early exploration stage.

Misconception 3: ESG is only about risk management

Treating ESG solely as risk management is also an important misconception. Indeed, ESG is crucial in risk and compliance management, such as avoiding negative environmental and social impacts, reducing legal liabilities, etc., but this is only a part of ESG. Between risk and opportunity, ESG is not just about risk control, it also encompasses important opportunities. ESG covers a wide range of areas, from risk and compliance to value management, and then to strategic advantage.

In addition to risk control, ESG can significantly improve the operational efficiency of enterprises, such as reducing operating costs and improving resource utilization through the use of clean energy. Meanwhile, ESG can also create 'value dividends', such as enhancing corporate reputation, attracting investors and talented individuals, and strengthening customer and supply chain trust. In addition, the ultimate goal of ESG is to drive industry innovation and achieve long-term sustainability by developing and promoting sustainable products and services.

Misconception 4: Treating ESG simply as non-financial performance evaluation

Many people view ESG as a purely non-financial performance evaluation tool, but this understanding is not comprehensive. Indeed, ESG provides companies with comprehensive measures of environmental, social, and corporate governance, which are often considered non-financial performance. However, the role of ESG goes far beyond traditional non-financial performance evaluation, providing investors with important long-term value judgments for companies.

As mentioned in the book 'The End of Accounting', the effectiveness of future investment project evaluations will be greatly reduced if they rely solely on information in financial reports. Although the views in the book are radical, they reveal a trend: financial data alone is not sufficient to comprehensively measure a company's investment value, and about 95% of a company's value needs to be evaluated through indicators other than financial reports, including ESG data. Therefore, the key role of ESG is to help investors evaluate a company's potential value and sustainability more comprehensively, rather than just supplementary information to financial reports.

Although China's attention to ESG is increasing, the mechanism for promoting widespread implementation of ESG by enterprises is still incomplete. Compared to the international development process of over a decade, China's ESG investment and corporate practice started relatively late. Although we expect financial institutions to have a stronger ESG impact on companies within five years, currently, there is still significant room for improvement in the level of ESG information disclosure by listed companies.

How much personal power does ESG drive? This is a crucial issue. Although consumers can influence corporate behavior through their consumption choices, currently, most consumers have a low acceptance of premium ESG products. This indicates that despite the deep-rooted ESG concept, there is still a gap between consumer behavior and ideology. On the one hand, business leaders should actively promote ESG practices; On the other hand, consumers should also enhance their awareness of ESG products and be willing to pay more for more sustainable products.

As the source of funds, personal investment is crucial for the development of ESG. Taking Asian family offices as an example, they should incorporate ESG into their investment decisions, but the reality is that this concept has not yet been widely recognized. Family inheritance and sustainable development should be consistent, but currently it seems that there is still significant room for improvement in ESG investment for family offices.

From China's perspective, the current policies are highly promoting ESG. If we can overcome the current bottleneck within five years and truly make most companies aware that ESG is something that must be promoted, I believe this will be a huge progress.

ESG poses new challenges to businesses

The latest developments in ESG have put forward many new requirements for enterprises, mainly reflected in large and medium-sized enterprises.

Firstly, implement a sustainable development performance management information system. Currently, enterprises generally have ERP, customer management systems, etc., but the vast majority of enterprises have not yet adopted a "sustainable development performance management system". I believe that ten years later, many enterprises will add this module, which will be a big change in the future. At present, only a few sharp startups are trying such systems, but large enterprises such as IBM, Microsoft, SAP, Lenovo, etc. are already developing and promoting similar systems, which will become standard for most enterprises in the future, although many enterprises still do not have a good understanding of them.

Secondly, manage the entire value chain, not just limited to first tier suppliers. At present, only a very small number of high-end electronic equipment, automotive and other industries in China are managed as second tier suppliers due to quality control reasons. Many companies even struggle to manage their primary suppliers, let alone their secondary suppliers. But with the development of ESG, companies not only need to manage secondary suppliers, but also extend to tertiary and quaternary suppliers, covering the entire value chain. For large enterprises, this means completely different management requirements. The underlying reason is risk - the risks of third and fourth tier suppliers can also become risks for the enterprise itself, including environmental risks and labor rights risks. Although these risks may not be easy to identify and assess at the beginning, your downstream customers may interrupt their business dealings with you in the future due to environmental or labor risk events that occur with your suppliers.

Carbon emissions, environmental and labor risks are not limited to first tier suppliers, but are likely to be more concentrated in second tier, third tier, or even fourth tier suppliers. Many companies may not even know their second and third tier suppliers, but now they must understand and manage these upstream suppliers. With the introduction of many relevant laws, especially the EU's newly formulated sustainable development due diligence regulations, it has not yet entered the stage of full implementation. However, for example, Germany has taken the lead in implementing the Supply Chain Due Diligence Act, and the implementation of these laws will have a significant and far-reaching impact on our businesses.

Once again, incorporate scenario analysis into the formulation of corporate strategy. For most companies, scenario analysis is a relatively unfamiliar management tool, typically only used by multinational corporations like Shell for their operations and development. Although future changes are difficult to predict, the judgment of several possible development directions in the future can provide important basis for the formulation of corporate strategies. For example, dealing with the development of globalization, geopolitical changes between China and the United States, or considering whether to go abroad are all application scenarios of scenario analysis. Companies listed on the Hong Kong Stock Exchange have been required to conduct climate scenario analysis, and mainland listed companies will gradually be required to implement it.

Fourthly, quantitatively evaluate the social and environmental impacts of enterprise operations. A few multinational corporations and individual mainland enterprises (such as Lenovo) may have already started quantifying their social responsibility impact. Traditional financial statements cannot reflect a company's positive contributions to society and the environment. Therefore, many leading companies are now conducting quantitative evaluations, but mainland enterprises as a whole have not yet reached this level.

With the continuous emergence of new requirements, these are new challenges posed by sustainable development to enterprises, as well as new opportunities for ESG pioneers to innovate.

Important Trends in Sustainable Business Transformation

Friends interested in practicing sustainable business can follow the following trends.

Suggestion 1: Discover the purpose of the enterprise and become a purpose driven enterprise. In the future, every enterprise needs to discover or redefine its purpose, which is the fundamental purpose of its existence. In 2019, some business leaders in the United States proposed that companies cannot solely serve investors. In the past, the purpose of enterprises was to create value and profit returns for investors, but now, the era of simply creating value for investors has come to an end. Enterprises must create value for a wider range of stakeholders, including employees, customers, and society. In China, I am pleased to see that some mainland enterprises have put forward more core corporate purposes beyond their mission and vision.

The purpose of a company is the fundamental reason for its existence. In other words, the era of purely profit oriented enterprises is coming to an end. If your only goal is to make money, your business path will become narrower and you may eventually face difficulties. Enterprises must clarify their contributions to society and the environment, which is the key to their long-term development.

The corporate purpose is the fundamental purpose of a company's existence, answering the question of 'why'. It clarifies the value and significance of the existence of the enterprise. Correspondingly, the corporate vision answers the question of "what kind of future the enterprise will become", while the mission focuses on "how to achieve" the purpose and vision of the enterprise. These three are interrelated and together form the strategic cornerstone of the enterprise. However, many companies have not yet clearly defined their purpose.

Taking Hong Kong MTR as an example, its mission has evolved from "Moving the City Forward" to "Moving the City Forward Sustainable", reflecting the company's emphasis on sustainable development. The existence of MTR is crucial for the normal operation of Hong Kong city. It not only provides efficient and convenient transportation services, but also undertakes the responsibility of promoting sustainable urban development.

As outdoor enthusiasts, many people are not unfamiliar with Patagonia. This brand, with the aim of "saving the earth with business", has won widespread acclaim worldwide. Although Patagonia is relatively small in scale, its outstanding performance in the field of environmental protection makes it stand out among many enterprises. Patagonia 'success proves that businesses can not only pursue commercial interests, but also become a positive force in promoting sustainable social development.

Suggestion 2: Actively participate in the global low-carbon transformation.

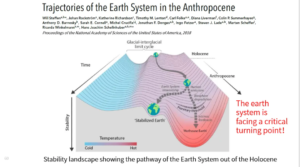

Although some still question climate change, scientific evidence is conclusive: we are experiencing the most stable climate period in the past 10000 years - the end of the Holocene. The global temperature continues to rise, and this year marks the first time it has surpassed the pre industrial revolution threshold of 1.5 degrees Celsius. Let us review this year at the end of the year and deeply appreciate the harsh reality brought about by climate change. This is just the beginning, the challenges ahead will be even more severe.

Last week in Dubai, I discussed the recent rare floods with local students. For a desert city, such severe floods are undoubtedly a warning of extreme climate change. Despite the rapid recovery of Dubai's core business district, many areas still need several months to fully recover. Local residents are generally concerned that similar extreme weather events may become the norm. However, they stated that Dubai is not prepared for the next flood.

On August 27, 2024, the United Nations Secretary General issued an urgent appeal to save our oceans. Rising sea levels are seriously threatening the survival of small island nations. However, due to the turbulent global situation, this call has not received sufficient attention.

It is difficult for us to accurately predict what kind of drastic changes will occur in society and the environment after the Earth's average temperature rises by 1.5 degrees, 2 degrees, 3 degrees, or even 4 degrees. If the specific consequences of different warming scenarios can be described more clearly, people may be able to deeply understand the urgency of climate change and change their current behavior. However, currently most people lack a clear understanding of the long-term impacts of climate change, which hinders them from taking action.

Some international mainstream ESG ratings assess the impact of corporate carbon emissions on global warming, and every company needs to answer this question. Some companies' operations will cause the Earth to heat up by more than 3.2 degrees Celsius. This result is not honorable for Zhao Lei's company.

For businesses, addressing climate change is crucial. Every enterprise needs to answer several key questions: Firstly, when will the enterprise achieve carbon neutrality and net zero emissions? Secondly, in the increasingly complex environment of the future, how can my enterprise maintain resilience and sustain operations? Thirdly, how can my company become an innovator in low-carbon technologies, products, and business models?

Responsible companies worldwide are committed to achieving a net zero transformation by 2050. Various industries in the EU are also striving to achieve carbon neutrality before 2050, such as the information and communication technology industry planning to achieve carbon neutrality by 2037, and the automotive industry aiming to achieve carbon neutrality by 2048. From the perspective of developed countries, 2050 is the deadline for achieving net zero emissions. The above chart shows the timeline for global companies to achieve carbon neutrality, which is different from our '3060 goal' and closely related to the 1.5 degree warming target.

As shown in the above figure, our Earth is at an important turning point, with two major directions for future development: one is to slide towards the "hell mode", like the fiery red "hot house Earth"; Another is to shift towards sustainable development.

Who ultimately decides the direction of future development? Enterprises are the biggest decision-makers. The future of humanity depends on the current decisions and choices of enterprises. Future business decision-makers will play an extremely important role. We urgently need to equip them with the concept and ability to implement sustainable business through education.

Make the development of circular economy a responsibility and business opportunity for every enterprise

If we want to achieve carbon neutrality, I think the biggest changes are two:

Firstly, bid farewell to fossil fuels. Fossil fuels are no longer used as energy, but may only be used as raw materials.

Secondly, society must transition from the current linear economy to a circular economy. The various raw materials required for future production will no longer be mainly extracted from nature, but will be obtained more from existing items. The current tables and chairs will become the raw materials for future tables and chairs, and most items will be recycled, no longer turning existing products into waste and discharging them into the natural world.

Our current resource consumption is too high. Every year, an "Earth Overloading Day" is announced, from which all the resources produced by the Earth this year have been exhausted, leading to a situation where income is not enough to cover expenses. From an economic perspective, we are now "eating from the past". August 1, 2024 is Earth Overloading Day, which means that there will be approximately 5 months this year when we will not be able to make ends meet.

The concept of circular economy has been proposed in China for a long time. As early as 1998, Shanghai first proposed the concept of circular economy, using knowledge economy and circular economy as two key drivers for development in the 21st century. However, in reality, the development of our circular economy is not ideal, and it is currently more limited to the resource recycling industry, becoming an industry thing.

My view is that circular economy should be the responsibility and opportunity of every enterprise, and its biggest change lies in the transition from products to services. The current business model is mainly focused on selling products, while in the future, it will be more centered on providing services. For example, Philips no longer sells lighting products directly to customers, but provides lighting services; InterFly does not sell carpets, but provides carpet rental services. The circular economy requires more business model innovation, including a fundamental shift from product sales to service provision.

The circular economy business model of product to service has been widely promoted in countries such as the Netherlands. For example, the Dutch company Bundles has implemented this model, where users do not need to purchase household appliances, but instead pay monthly usage fees through signing contracts to enjoy high-end household appliance services. Enterprises can also provide suggestions to users, such as informing them whether a washing machine is suitable for home use, and sharing relevant information with users through sensing technology. In the past, the goal of enterprises was to enable users to eliminate and replace products as early as possible, but from the perspective of circular economy, enterprises now actively extend the service life of products and pay attention to product quality management.

Finally, let's review and summarize: What exactly is ESG? From a macro social perspective, ESG is a fundamental social change driven by various sectors of society (i.e. external stakeholders of the enterprise) to transform the enterprise from a creator of environmental crises and social problems to a solver of environmental crises and social problems. From a micro enterprise perspective, ESG is a management framework for assessing the risks and opportunities faced by enterprises due to changes in market and non market factors, and is a fundamental approach to promoting long-term value creation. It is a new enterprise evaluation model that incorporates the social and environmental value of the enterprise into the scope of quantification and monetization, and combines it with finance for comprehensive evaluation.

Running a business is not only for profit, but also requires a clear understanding of the positive impact that the enterprise has on society and the environment, and actively spreading it to the outside world in order to win recognition from society. Enterprises should have at least two licenses: a business license and a social license. The latter represents society's recognition of the enterprise and is the most important guarantee for the enterprise to become a century old store. At the same time, consideration should also be given to what actions to take in response to climate change, as well as how to view the circular economy as an opportunity and responsibility for future development.